Story

"The markets can stay irrational longer than you can stay solvent."

In 2010, I had an idea for buying and selling stocks that used some very simple statistical ideas. I wrote a Perl script that would generate a daily list of stocks and price points. Though generating the daily list was done automatically, the monitoring of the stocks was done manually. Still, I employed this system for about 4 or 5 months and racked up a 30% return on investment. Making money in the market is easy I thought.

The market had generally gone up during this period. It did not go up 30%, so there must be something to my strategy, but would this strategy work if the market was not tranding upwards? I changed positions in my job among other life factors that gave me less time to be doing this sort of trading. But come 2013, I had the opportunity to revisit my ideas.

I set out to try automate the system and create a nice web application for it (using Python and some Javascript/HTML). It worked like this:

- Each night, pull down the daily stock quotes needed for the analysis.

- Run the analysis and generate a candidate list with buy/sell thresholds.

- Show the candidate list with links to useful information about the stock.

- When the market opened, being pulling in real-time quotes for those stocks every minute (thank you for the API Google).

- Raise an alert (flashing screen, alarm sound, email or SMS) when a threshold was met or being near met.

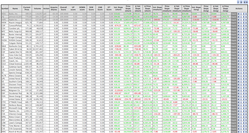

- Allow me to enter the trades, and keep track of and display my portfolio.

- Also monitor what was existing in my portfolio to alert me to "sell" events when those thresholds were met or near.

- Allow me to see the analysis stats and the daily performance graphs.

The problem though was that my strategy was doing pooorly. I then spent a lot of time making more sophistated versions using machine learning algorithms. Nothing I tried worked though. In fact, these performed much worse that random chance. I grew mighty suspicious of the market as it seemed like not matter what I did, the market moved against me. I attribute this to the high-speed trading shennanigans where those with the faster views of the data really were using to their advantage.

I gave this up for now, though maybe I will resurrect it some day.

Cassandra.org

Cassandra.org